GL Report

The GL Report summarizes financial transactions in a specific period, making it easier for brokers to add journal entries and track financial performance.

Revenue and Expense Accounts

By creating Revenue and Expense accounts, you can divide freight by different types of accounts for your business.

To do this for QuickBooks, you can create subcategories under the TRANS and Freight COS account types, or you can set up entirely new account types to keep everything separate.

If you're using a different accounting system, you can still take advantage of these same capabilities by connecting to our APIs or creating GL Accounting Reports. This will allow you to customize your categories and reports in the way that works best for your business, regardless of which system you're using.

Where to set up your Revenue and Expense accounts

- Click on the Accounting tab and scroll to Accounting Sync.

- After accessing this page, look for GL Accounts.

Account Types

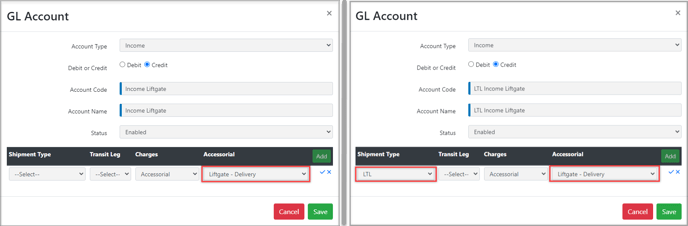

The account types that allow you to add filters are Cost of Goods Sold, Expense, and Income.

After selecting any of the mentioned, you will see a new option to add filters such as Shipment Type, Transit Leg, Charges, and Accessorial.

Rules

- If you are using QuickBooks as your accounting system, the account code must exist as a service for income accounts and an expense account under the Chart of Accounts.

-

When creating an invoice or bill that satisfies all the criteria, the system will give precedence to the GL Account with the most specific level of detail. Therefore, the most detailed GL Account will be prioritized and applied first.

Example: LTL Income Liftgate provides a higher level of detail compared to Income Liftgate because it has a shipment-type filter. So when you sync an LTL Invoice, and the shipment includes Liftgate as an accessorial, the system will prioritize associating the invoice with the GL Account for LTL Income Liftgate.

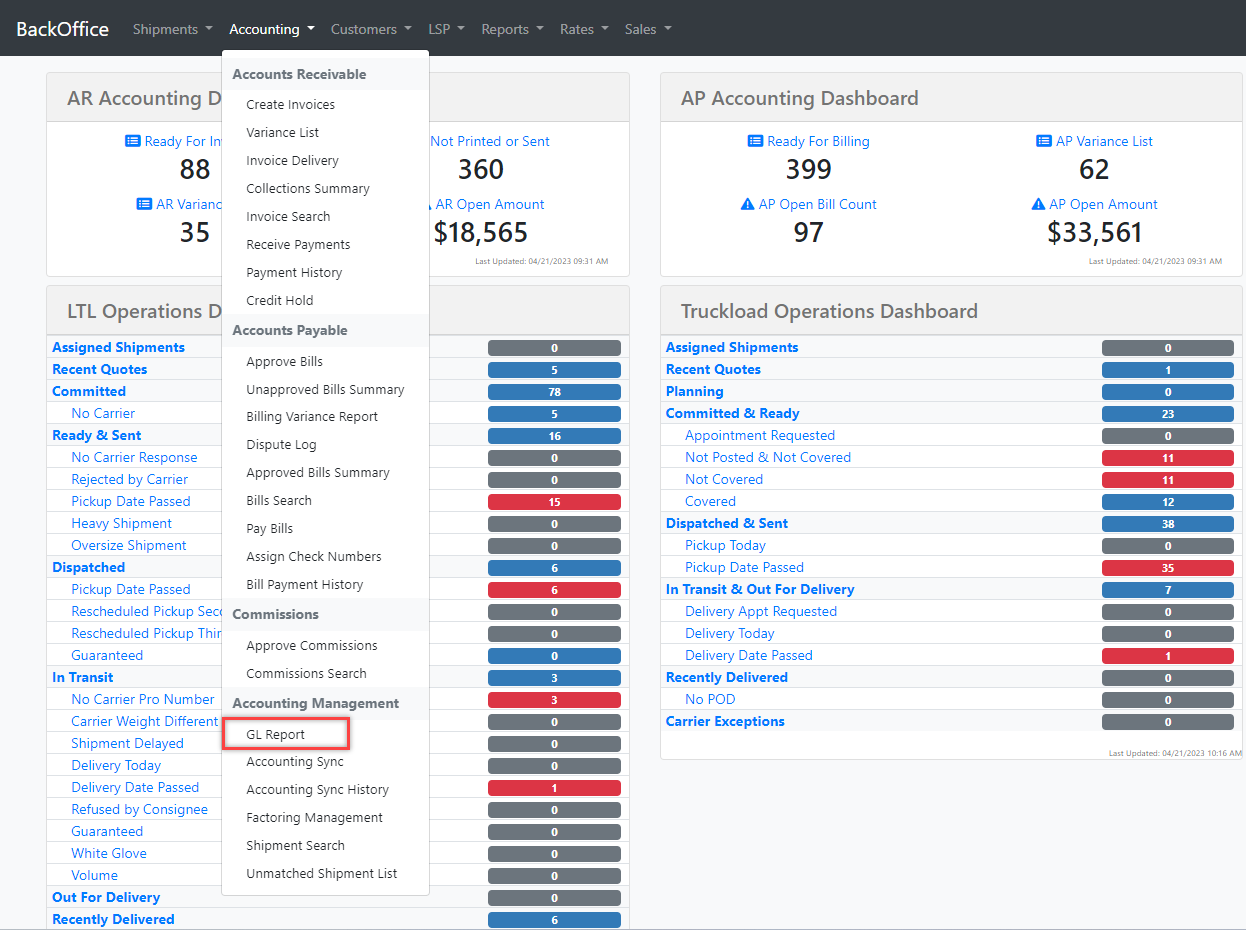

Where to find the GL Report

Look for the report in the accounting tab under accounting management.

GL Report Summary

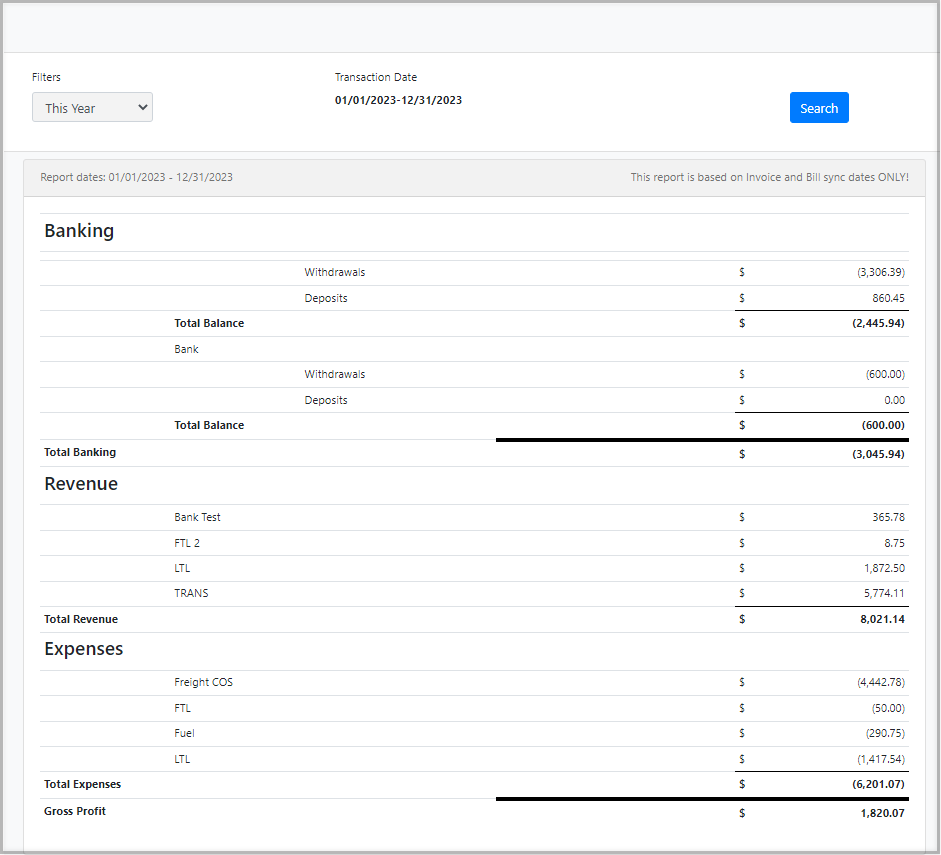

Please remember that this report is actually summarizing your financial transactions.

We separated the GL Report into sections. Banking represents your Cash Flow, and Revenue and Expenses represent your P&L (Profit and Lost)

Within each of the mentioned sections, we will provide you with the Account Code and Account Name that you have configured in the Accounting Sync.

The system uses the Sync Date as the Transaction Date to generate the GL Report.

Sync Date (Transaction Date)

- QuickBooks: This date is added the moment you sync an invoice or a bill.

- APIs: You have to mark it as synced using the endpoint.

- GL Accounting Reports: The system adds the sync date for all the invoices and bills created during that day at the end of each day.

When generating GL Accounting Reports, you can choose to add this date only for Accounts Payable (AP), only for Accounts Receivable (AR), or for both. It is recommended to include both AP and AR sync dates.

Request this to our Support/Onboarding teams.

Something valuable is the ability to navigate back to previous months, so you can easily view month-end closings.

Best Practice for Fuel

The fluctuation of fuel prices adds volatility to finances, which can result in a peculiar pattern of revenue. One month may show a surge in revenue, while the next may demonstrate a decline. However, it's crucial to note that the decrease in revenue is not necessarily signifying a reduction in business operations. For instance, an increase in shipments could lead to higher income. Still, if fuel costs also rise, the profit percentage may decrease, creating a misleading picture of the overall financial situation.

As a best practice, segregating fuel expenses in your General Ledger Report can provide you with a clear and accurate overview of the impact of fuel costs on your finances.