Credit Hold Workflow

The Credit Hold function allows users to halt shipments from auto rating (front office) and blocks a load from advancing past the Committed status.

Credit Hold

Credit Hold is a status in the customer's accounting profile that has added functionality that allows the user to stop the end customer from rating in the front office and enables the ability to block the shipment from advancing past the Committed status when engaged.

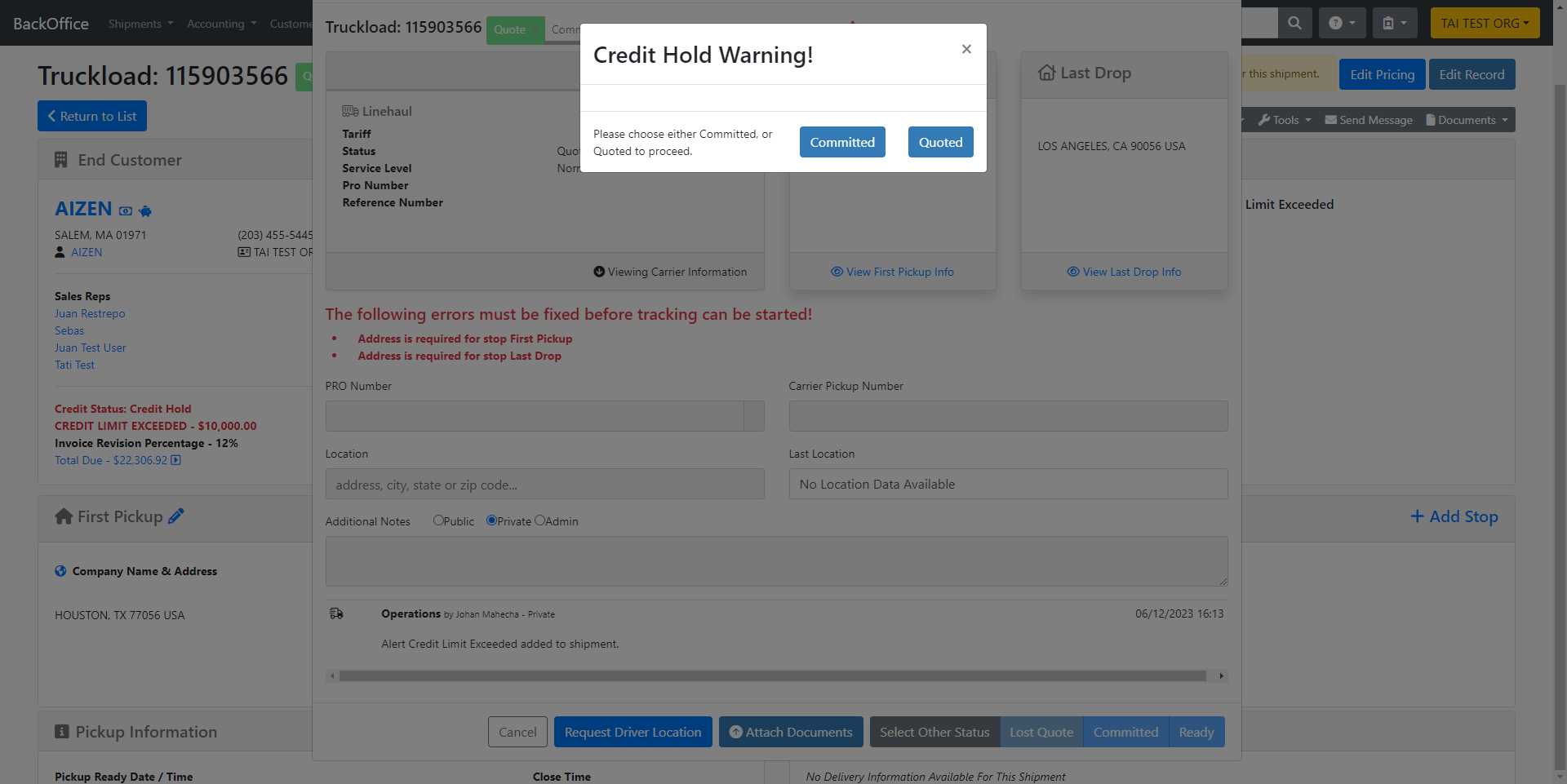

Backoffice

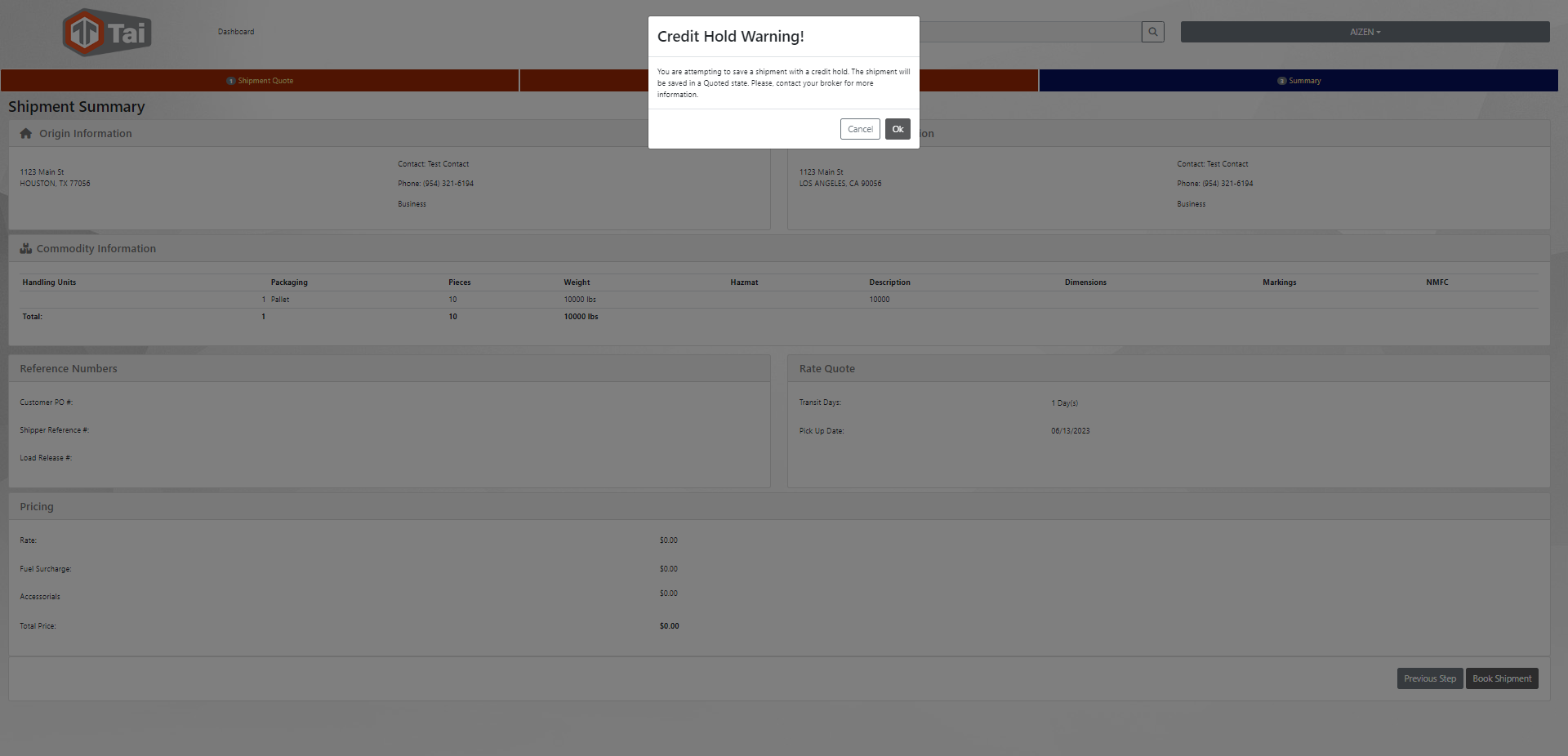

Frontoffice

These messages are customizable within content templates by looking for:

-

INFO Front Office Credit Hold

-

INFO Back Office Credit Hold

Setup

In the customer's profile:

- Click on Edit Accounting Profile

- In the Credit Status section, set the Credit Status to Credit Hold

- When this occurs, a Credit Hold entry will be made, ensuring that all Front Office auto ratings are blocked. This is done by adding rating blocks to the Credit Hold page.

- The Credit Hold page can be accessed by clicking on the Credit Hold link in the Accounting Information section:

- You can Block All Tariffs or a Specific Tariff (set of tariffs) and put a note to tell other users the reason for the block.

- Click the Trash Can Icon to delete a Credit Hold and remove the block on the customer.

- If a Credit Hold is resolved from the Accounting Profile, the "Block All Tariffs" entry on the Credit Hold page is automatically removed.

- Users can enable tracking by going to the customer's Accounting Profile settings, temporarily changing the credit status, initiating tracking, and setting the customer back to the credit hold status.

Auto Apply Credit Hold

The Auto Apply Credit Hold feature can be enabled from the LSP Org Settings page. When enabled, the system will auto-apply the credit hold status to the customer's accounting profile whenever the Credit Limit goes from acceptable to exceeded.

When the system assigns a credit hold status to a customer's accounting profile, and you determine that the customer's credit status has returned to acceptable, you must manually remove the credit hold. This action will automatically refresh the credit hold information under Accounts Receivable and make the relevant tariffs visible in the front office.

A credit hold will not be triggered if a customer's credit limit has already been surpassed. Credit holds are specifically applied when a customer's credit status transitions from acceptable to exceeded. This design is intentional and relates to the Credit Hold Override functionality.

Credit Hold Override

If a customer is currently in a state where their credit limit has been exceeded and holds a Credit Hold status, authorized users can modify the Credit Status to remove the Credit Hold. In this situation, these customers will not automatically receive a new credit hold. However, should their credit limit situation improve and subsequently be exceeded again, the system will activate the automatic Credit Hold process.